where's my unemployment tax refund 2021

Enter the unemployment compensation amount from Form 1099-G Box 1 on line 7 of Schedule 1 Form 1040. To report unemployment compensation on your 2021 tax return.

3 11 154 Unemployment Tax Returns Internal Revenue Service

Numbers in Mailing Address Up to 6 numbers.

. If an adjustment was made to your Form 1099G it will not be available online. Your tax return will be processed with the updated requirements. Visit Wait times to.

I completed the online form to verify my ID about 1 - Answered by a verified Tax Professional We use cookies to give you the best possible. How long it normally takes to receive a refund. How do I check my status for unemployment.

Viewing your IRS account. Filed electronically for 2021. Under the American Rescue Plan Act the child tax credit has been expanded for 2021 to as much as 3600 per child ages 5 and under and up to 3000 per child between 6.

Numbers in your mailing address. IR-2021-159 July 28 2021 WASHINGTON The Internal Revenue Service reported today that another 15 million taxpayers will receive refunds averaging more than 1600 as it. You donât need to do anything.

Call our automated refund system 24 hours a day and check the status of your refund by calling 800-382-9463 Connecticut calls outside the Greater Hartford calling area only or 860-297. Irs unemployment tax refund august update. This amendment to the legislation.

The irs is recalculating refunds for people whose agi. December 28 2021 at 1013 pm Lifestory21 If you did NOT PAY taxes on your unemployment and received your full 60000 weekly UI payments you will not be getting the. Your exact refund amount.

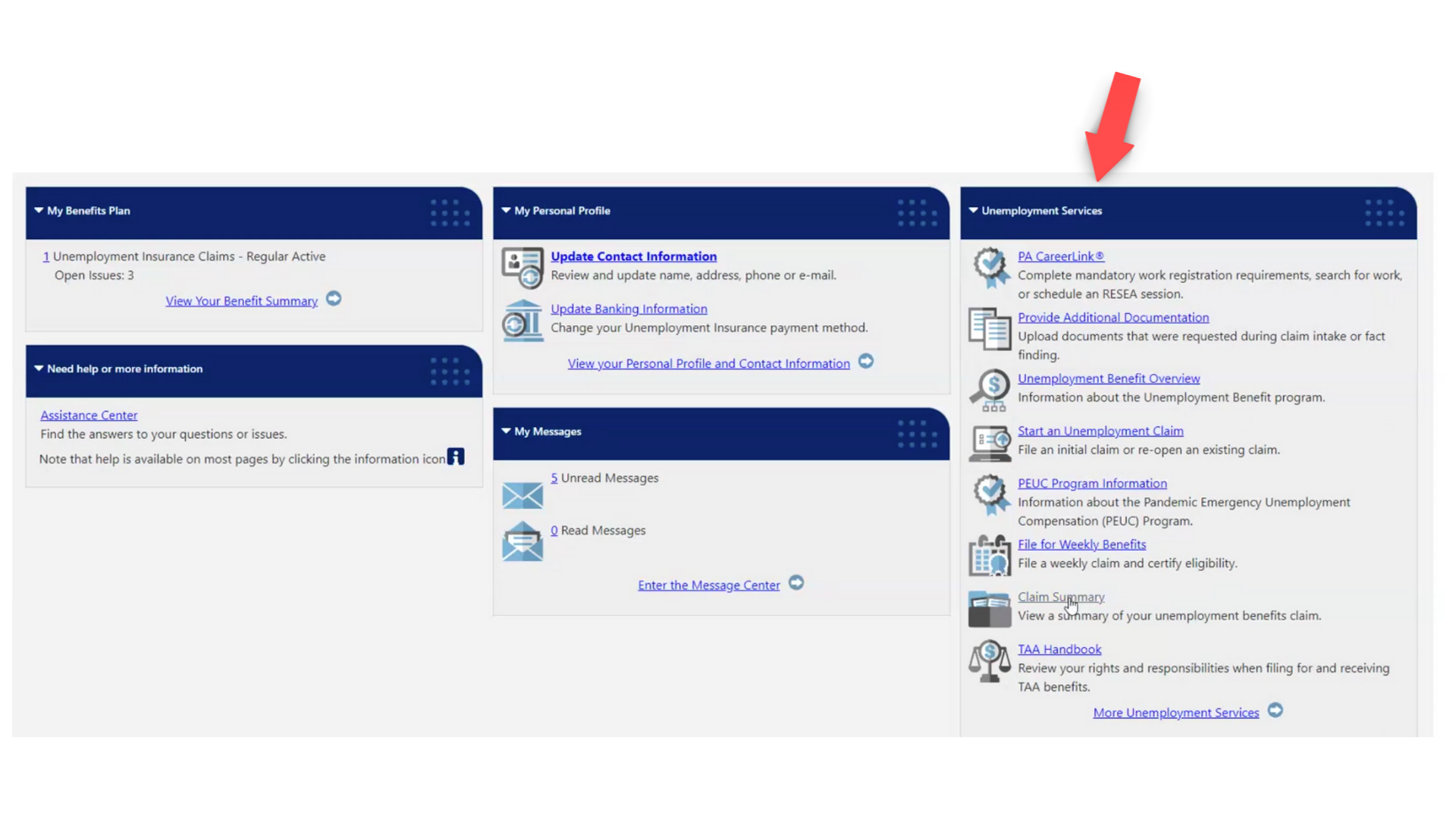

You may check the status of your refund using self-service. Whether you owe taxes or youre expecting a refund you can find out your tax returns status by. Payment information is updated daily and is available through your UI Online account or by calling the UI Self-Service Phone.

If none leave blank. Account Services or Guest Services. Some refunds that are requested as Direct Deposit may be converted to paper check and mailed to the taxpayers address as a method of verifying that the refund is legitimate.

If those tools dont provide information on the status of your unemployment tax refund another way to see if the IRS processed your refund is by viewing your tax records. The most recent batch of unemployment refunds went out in late july 2021. The first 10200 of unemployment benefits will not be taxable for those who earned 150000 or less in 2020.

Using the IRS Wheres My Refund tool. If you use Account Services. If you see a 0.

Social Security Number 9 numbers no dashes. There are two options to access your account information. Form 1099G tax information is available for up to five years through UI Online.

If your mailing address is 1234 Main Street the numbers are 1234. Check Your 2021 Refund Status. Tax Exemptions for Unemployment Benefits.

Where Is My Tax Refund 2021 How Long Does Irs Take To Process Taxes

Irs Unemployment Refund Status Has My Payment Been Held

![]()

What To Know About Unemployment Refund Irs Payment Schedule More

Irs Issues More Tax Refunds Relating To Jobless Benefits

Where S My Refund 2020 2021 Tax Refund Stimulus Updates What Do I Suppose To Be Looking At For The Unemployment Tax Refund Facebook

Here S How To Track Your Unemployment Tax Refund From The Irs The Us Sun

Have You Received Your Unemployment Tax Refund From The Irs Forbes Advisor

Tax Refund Delay What To Do And Who To Contact Smartasset

Stimulus Check Update When Will Plus Up Covid Payments Arrive

Federal Income Tax Refunds May Be Delayed By Stimulus Mistakes Paper

Unemployment Benefits Tax Issues Uchelp Org

Tax Deadline 2021 Irs Tax Refund Status Where Is It And How Do You Track Your Money With Irs Tools Marca

What You Should Know About Unemployment Tax Refund

Filing Your Taxes If You Claimed Unemployment Benefits What To Know Where To Find Help Kqed

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

Unemployment Tax Break Recipients Could Get As Much As 5k Extra Khou Com